Boost Your Financial Health with Tailored Loan Service

Boost Your Financial Health with Tailored Loan Service

Blog Article

Discover the Perfect Financing Providers to Meet Your Monetary Objectives

In today's complex economic landscape, the quest to discover the excellent financing services that line up with your unique monetary objectives can be a daunting job. With many options readily available, it is vital to browse with this labyrinth with a tactical approach that ensures you make notified choices (Financial Assistant). From recognizing your monetary demands to assessing loan provider reputation, each action in this procedure needs careful consideration to safeguard the most effective possible outcome. By following a methodical approach and considering all factors at play, you can place on your own for economic success.

Analyzing Your Financial Requirements

When considering funding solutions for your monetary goals, the first action is to extensively assess your current monetary requirements. Begin by reviewing the particular function for which you need the lending.

Furthermore, it is important to conduct a comprehensive evaluation of your existing financial scenario - merchant cash advance with same day funding. Compute your revenue, expenditures, possessions, and liabilities. This examination will certainly offer a clear image of your monetary health and wellness and payment ability. Take into consideration factors such as your credit report, existing debts, and any kind of upcoming expenses that might affect your ability to pay back the finance.

Along with recognizing your financial needs, it is suggested to study and compare the lending options readily available out there. Different loans come with differing terms, rate of interest, and settlement routines. By thoroughly assessing your requirements, monetary setting, and available loan items, you can make an enlightened decision that sustains your financial goals.

Understanding Loan Alternatives

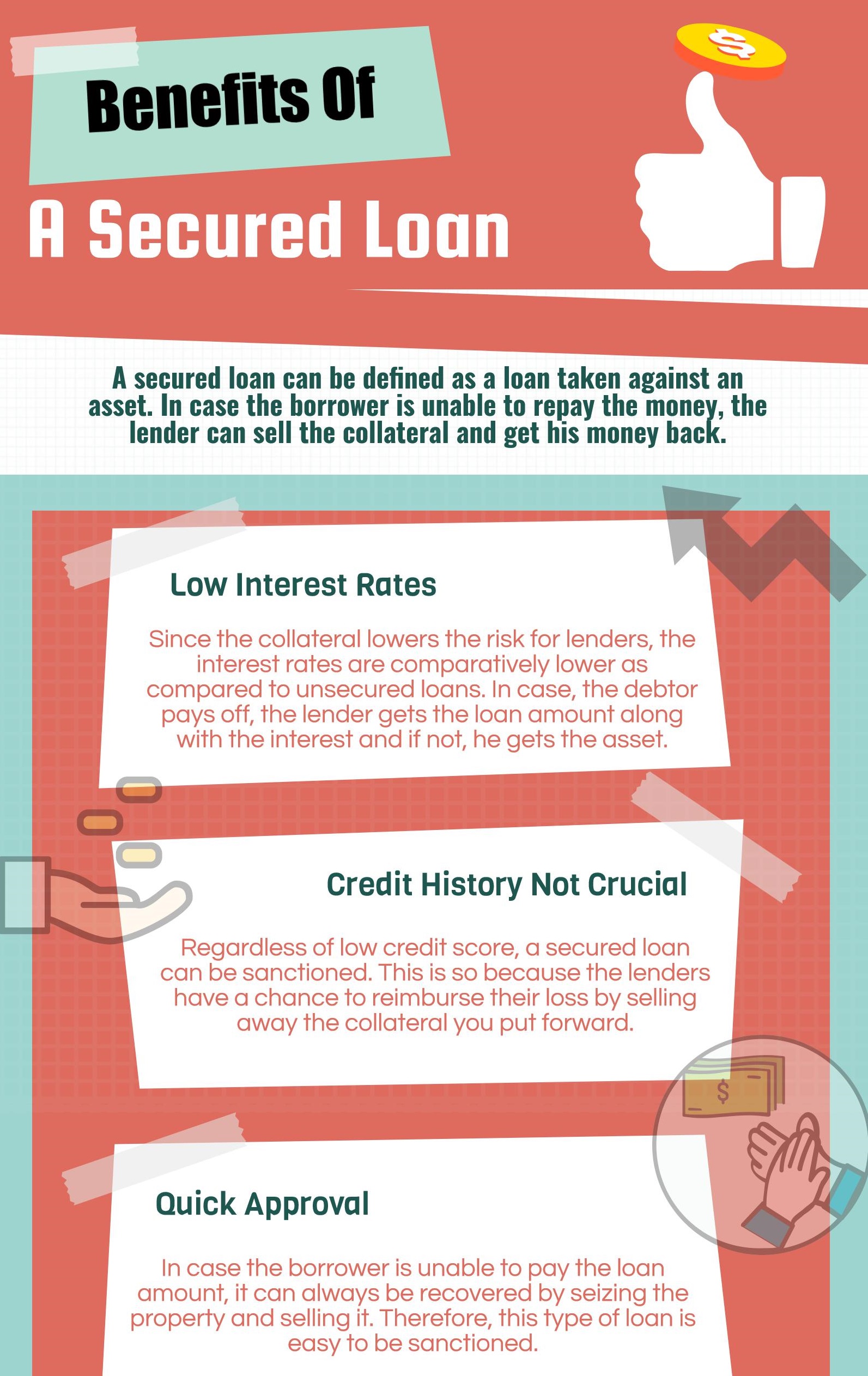

Exploring the variety of loan options offered in the financial market is important for making informed decisions straightened with your certain demands and objectives. Understanding car loan alternatives entails familiarizing on your own with the various kinds of financings offered by monetary establishments. These can vary from standard choices like personal fundings, home loans, and vehicle loans to more specialized products such as home equity fundings, cash advance, and trainee finances.

Each sort of funding includes its very own terms, problems, and repayment structures (quick mca funding). Individual fundings, for circumstances, are unsafe loans that can be utilized for various functions, while home mortgages are safeguarded finances particularly made for buying realty. Auto loans accommodate funding automobile purchases, and home equity finances permit homeowners to borrow against the equity in their homes

Comparing Rate Of Interest and Terms

To make informed decisions concerning finance alternatives, an essential step is comparing rate of interest rates and terms provided by economic organizations. Recognizing and contrasting these terms can aid consumers pick the most suitable financing for their monetary situation. Additionally, analyze the effect of car loan terms on your monetary goals, making certain that the selected loan aligns with your budget and long-term purposes.

Evaluating Lender Track Record

Additionally, consider talking to governing bodies or monetary authorities to guarantee the loan provider is qualified and certified with industry laws. A credible lending institution will have a strong performance history of moral loaning methods and transparent interaction with borrowers. It is likewise advantageous to seek recommendations from close friends, family members, or economic consultants that may have experience with trusted lending institutions.

Ultimately, selecting a lender with a strong track record can offer you tranquility of mind and confidence in your borrowing choice (best merchant cash advance). By conducting comprehensive study and due diligence, you can choose a lending institution that lines up with your monetary objectives and values, setting you up for a successful borrowing experience

Picking the very best Financing for You

Having completely reviewed a lending institution's online reputation, the following vital action is to carefully pick the best car loan option that lines up with your economic goals and needs. When selecting a lending, take into consideration the purpose of the finance.

Contrast the rate of interest, funding terms, and costs provided by various loan providers. Reduced rates of interest can conserve you money over the life of the car loan, while favorable terms can make settlement a lot more workable. Variable in any kind of additional expenses like source charges, prepayment penalties, or insurance policy needs.

Choose a finance with regular monthly repayments that fit your budget and timeframe for payment. Eventually, select a funding that not only fulfills your existing monetary requirements however also supports your lasting monetary objectives.

Conclusion

Finally, discovering the perfect loan solutions to satisfy your monetary objectives requires an extensive evaluation of your financial pop over to this web-site needs, understanding finance alternatives, contrasting passion prices and terms, and reviewing loan provider credibility. By thoroughly taking into consideration these variables, you can select the ideal loan for your details scenario. It is very important to prioritize your financial goals and choose a lending that straightens with your long-term monetary objectives.

Report this page